Options, Calls and Puts, Premium: A guide for beginners

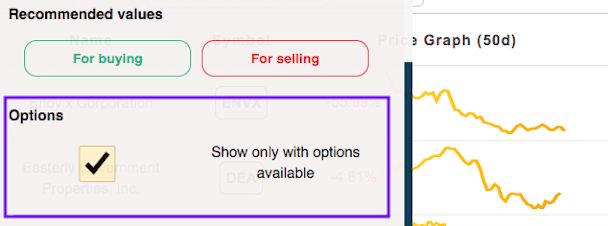

On our platform it’s possible now to filter companies by the availability of options. In this regard we decided to introduce you to this more advanced trading tool.

What is an option?

An option is a contract according to which the buyer acquires the right and the seller gets the obligation to buy or sell an asset within a certain period of time (before the expiration date) at a predetermined price (strike).

The value of an option can be divided into two categories: intrinsic and time.

The intrinsic is zero until the option is profitable, while the time is zero only at the time of expiration. Time value represents the monetary value of the risk that an option involves. Every day the option becomes cheaper, however, we will talk later about the factors affecting the cost of the option.

Difference between call and put options

A call option gives its buyer the right to buy an asset at a fixed price at a specified time. Accordingly a put option gives the right to sell the asset.

By purchasing a call option, the buyer expects the price of the underlying asset to rise in the future. In this case, he will be able to exercise his right to “purchase” at the price specified in the contract (the one which is below the market price) at the expiration of the option.

There is an opposite scheme with put options: the buyer expects the price to fall below the contract price in order to sell the asset at this price in the future.

The key idea is that the buyer has the right to refuse the terms of the contract, but if he still decides to exercise them, the seller is obliged to fulfill them. The main goal of both the buyer and the seller is to earn on their expectations.

Example time

Let’s suppose you want to buy 100 shares of company X, but at the moment you only have enough savings for 90 of them (the current value of one share is $100).

In 3 months you will receive a quarterly bonus and will be able to complete the transaction. But in 3 months the price may rise, and the amount of money you have may be again insufficient.

To insure yourself against a possible price increase, you buy a call option with a strike of $100 and an expiration date in 3 months and pay a premium of $100 for it.

In 3 months you may encounter the following situations:

a) The price of one share would become $110:

Then the value of all shares on the market will be equal to 110*100=11000$

Option share price is 100*100+100 (premium)=$10100

Total: +900$ (11000$-10100$)=900$

b) The price of one share would become $90:

The cost of shares on the market will be equal to 90*100=9000$

Option share price: 100*100+100 (premium)=$10100

It has become unprofitable to buy shares under the option, since the market value is less. In such case, you will waive your right to purchase under the contract and pay only the $100 premium.

Total: -100$

c) The price of one share would remain the same $100.

Price of shares on the market is 100*100=10000$

Option share price is 100*100+100=10100$

Total: -100$

Thus, it doesn’t matter if the shares are purchased at strike or market price, because in either of the cases you will pay $10,000 if a buy decision is made, and you will also pay $100 as a premium.

The example demonstrates that buying a call option implies the expectation of a rise in the stock price.

Now let’s move on to what does affect the value of an option or its premium.

There are 3 factors that affect the amount of the premium:

1) Price of the underlying asset

The greater the difference between the price of the underlying asset and the strike, the cheaper the option is, since the probability of the current price rising or falling to the strike price decreases.

Depending on the difference between the current price and the strike, options can be in-the-money, at-the-money, and out-of-the-money. They should be distinguished in order to understand what responsibilities you assume in different cases.

Let’s consider the cases for call options:

- in the money means the current price is above the strike (intrinsic value is positive);

- at the money means the current price is equal to the strike (intrinsic value is equal to zero);

- out of the money means the current price is below the strike (intrinsic value is zero).

And also cases for put options:

- in the money means the current price is below the strike (intrinsic value is positive);

- at the money means the current price is equal to the strike (intrinsic value is equal to zero);

- out of the money means the current price is above the strike (intrinsic value is zero).

2) Days before the expiration date

The closer the expiration date, the lower the risks of the seller and the lower the cost of the option, since the probability of an insured event becomes more predictable.

3) Implied volatility (implied/expected volatility)

Implied volatility (IV) is the expected volatility of the underlying asset over the lifetime of the option.

The higher the expected volatility, the more risk the seller takes. A volatile stock will have a high IV and the option price will be high. A stock with low volatility will have a low IV and the option price will be low.

When does the IV rise?

- During reports period: in most cases, it rises as a reaction to the expected report, when the stock may show significant fluctuations by tens of percent.

- In wait for an important event or news that affects the fate of the company.

Thus, in this article we got acquainted with the tool that many people heard about, but are scared because of its complexity. However, options are definitely worth attention, because this is a cool opportunity for unlimited profits with limited losses.

Our MonInvAI platform can become your assistant, which evaluates the attractiveness of investing in stocks and cryptocurrencies and can also be used to find curious options.